A good understanding of basic maths skills is essential to organising your finances.

Did you ever wonder why maths was so essential in school? It's simple, maths helps makes our life orderly and prevents chaos, whether it's in school, at work or at home, we all use some form of maths every day, whether we’re aware of it or not.

Budgeting is a very practical and often necessary process. Now more than ever we need to be careful about money, we live in a society where our cost of living and taxes are creeping up by the week and yet our income hasn't changed.

What do I mean?

The simplest example I can give is Milk, in the beginning of the year 2022, 2 litres of any supermarket's own brand of milk cost just €1.49 but by the year's end the same product was €2.29.

Now, this didn't happen with just milk, it happened across most food produce, tax and cost of production mean most people's grocery bills increased dramatically.

And it didn't stop there, there were also increases in utilities across the board. And the real crippler, is no pay increases yet, to match these rises in the cost of living. So, how do we cope?

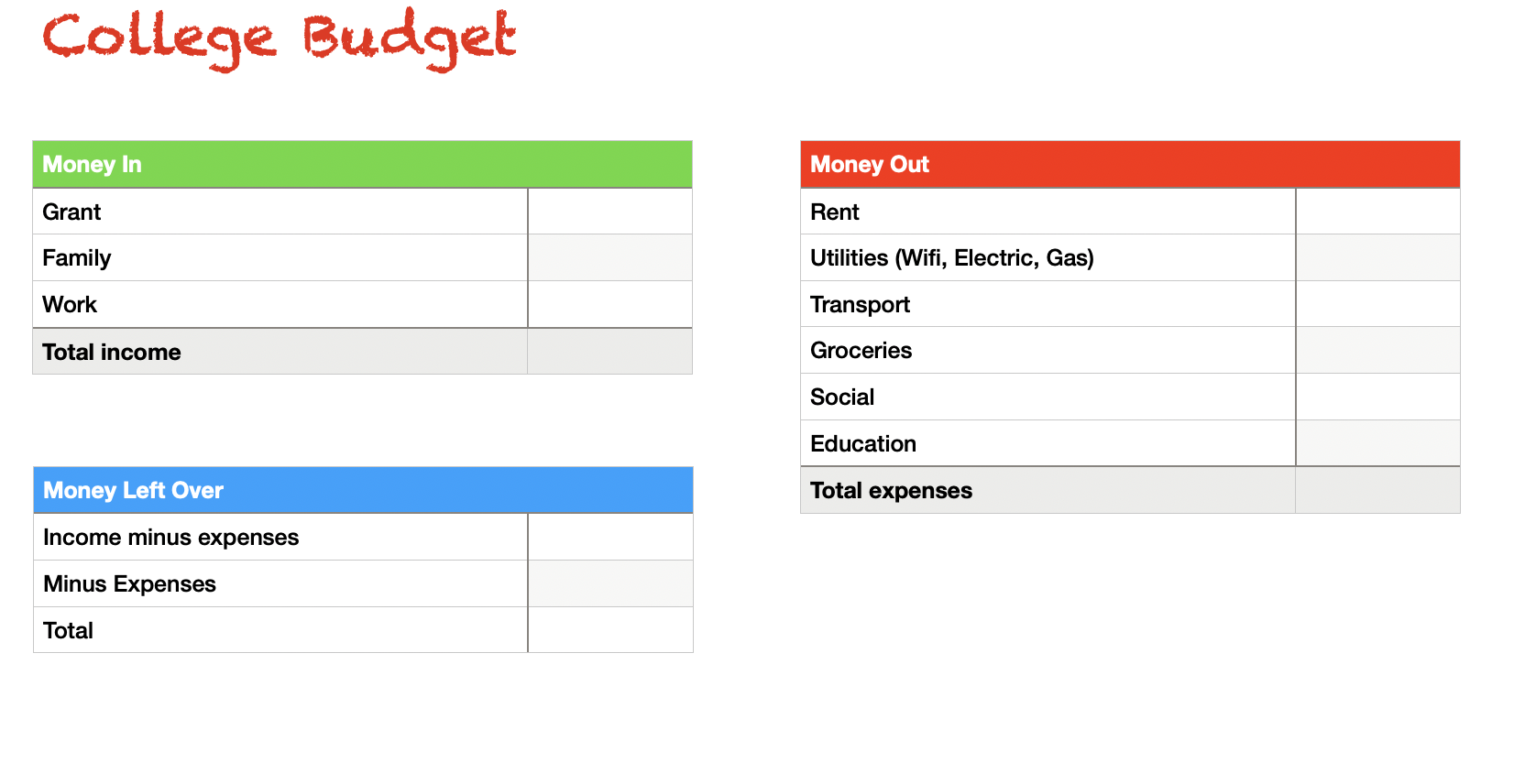

Step one: Budget

Dealing with money is an essential part of life. Everyone uses it, everyone needs it, yet many people consider money to be at the heart of their biggest problems.

However, money does not have to be a problem, it does not even need to be a solution. If you can find a balanced relationship with money, you may find that some of your stresses and worries disappear overnight without a pay raise.

MABS have a budget tool which is really so handy. The tool will calculate your figures and show income and expenditure in weekly, monthly and yearly amounts. You can save it and make changes as needed.

Why Make a Budget?

Everyone can benefit from making a budget, not just people who are having trouble making ends meet.

A budget is especially important if you:

- Want to make the most of your money

- Don’t know where your money is going

- Don’t save regularly

- Have problems paying your bills or debts

- Feel like you’re not in control of your finances

- Are planning for a major purchase or a life event?

Making a budget can help you feel better, less anxious and more in control of your money It can also help you to have more money for things that are important to you.

The Daily Maths and Practical Skills Involved in Being Better with Money

First

We take your actual income each month. This is the amount that comes into your account after all taxes and pensions have been detected. For the sake of this article, we are calculating a family of 4 with two teenage children so the education needs, are of secondary school level.

Average monthly net income for a 2 income Household, on the two most common take-home pay rates:

€2,417 + €2,901 = €5,318

Second

We make a list of all the unavoidable payments you have every month. Below is a list of the most common unavoidable payments in the average Irish Household.

- Mortgage/Loan (€1,000 AVG)

- Electricity (€180 AVG)

- Gas/Heating (€160 AVG)

- Groceries (€600 AVG)

- Transport (€250 AVG)

- Education (€200 AVG)

- Health Insurance (€150 AVG)

- Refuge (Bins) (€30 AVG)

- Internet (€60 AVG)

- TV/Streaming Services (€70 AVG)

- Mobile/Phone Services (€80 AVG)

Now let's subtract these averages from our average 2-income household.

After all of the above payments are made there will be about €2450 left over.

If this was a single-earner family, the first thing that would have to go is the health insurance (other supports available) Then one of the mobile phone payments would be gone and of course, some of the streaming / TV services would have to be compromised. This is how maths helps us with budgeting.

If you want to find out more or struggle to get a grasp on these equations, why not try a few refresher lessons with a Superprof Tutor today?

Revolut Vaults and Pockets | How Can They Help Me Be Better With Money?

Vaults are a feature in the Revolut app that allows you to save money towards both short and long-term goals.

Why Use Vaults?

You can customise your Vaults to work for you by setting goal amounts and deadlines to make sure you’ve got the money you need when you need it. You can also set it so that a recurring amount goes into a certain Vault, weekly or monthly ensuring that you never miss a Vault top-up.

Next, Pockets! Bills are automatically paid from your Pocket, so you’ll never miss a payment or overspend bills money again.

Why Use Pockets?

Pockets is a relatively new feature with Revolut, it was created to ensure that they’re not accidentally spending money that should go to bills. People can set up scheduled payments, create their Pockets, sort bills and set money aside, and Revolut will make the payments on the due date.

If customers already have scheduled payments set up with Revolut, all they need to do is create their Pockets for their various subscriptions and bills, and then sort their bills into them. Revolut will make sure they are paid when they’re due.

Why Use Revolut?

The bottom line, Revolut is a FinTech that allows users to purchase items; transfer money to other accounts (including abroad across 29 currencies) and offer better control of money and spending due to convenience.

The main benefits of using Revolut include the ease of use and simplicity of service, with the high quality of its mobile app and Apple/Google Pay and the choice to purchase a physical card. Oh, and it's free.